Introduction

I was recently in a conversation about forecasting with a client team, and one individual, whose background was not in supply chain, asked what the value of demand forecasting is. The answer may seem obvious to supply chain professionals, but it’s worth taking a step back and thinking about how to answer this.

Of all the most common metrics used to measure supply chain performance, forecast accuracy is the most difficult for colleagues outside of the supply chain function to relate to corporate goals like customer satisfaction and profitability. For example, fulfillment metrics such as on-time in-full and out of stocks have an intuitive meaning, because we are all shoppers and understand the disappointment customers feel if they can’t get an item they want. Inventory metrics are less intuitive, but ever since U.S. companies started adopting lean manufacturing and just-in-time principles in the 1980s, most business people have been trained to understand that excess inventory ties up capital and erodes profitability.

The link between forecast accuracy and corporate goals is less clear. But that doesn’t make forecasting any less important. Efficiently and effectively managing your supply chain starts with a good forecast, because you need to know what customers will order so you can ensure you have adequate raw materials, manufacturing capacity, and distribution resources.

“We know that our ability to maintain margin depends on our understanding of customer demand within and across categories.”

Adrian Mitchell, CFO, Macy’s, Inc.

If there are any doubts about the importance of forecasting, a look at the financial headlines should erase them. Even with the pandemic behind us, companies continue to struggle with forecasting volatile demand, and it has a direct impact on their bottom lines. A Wall Street Journal article titled “Retail CFOs Face Forecasting Challenges as Inventory Hurdles Persist” illustrates this. Underestimate demand and you may suffer from lost revenue. Overestimate demand and you will face a glut of inventory and may have to sell excess stock at discounts to avoid waste and free up warehouse space and working capital. The article quotes Macy’s CFO, Adrian Mitchell as saying, “We know that our ability to maintain margin depends on our understanding of customer demand within and across categories.”

How Exactly Does Forecasting Help Companies Achieve Company Goals?

When companies evaluate investments in their supply chain capabilities, they tend to focus on cost reduction rather than top-line improvements. This is to a great extent the result of an antiquated view of supply chain operations as a cost center rather than a source of strategic advantage. Those days are over, as companies such as Apple and Amazon have demonstrated that supply chain capabilities, including forecasting, can be a source of superior revenue growth and market share, in addition to lower costs.

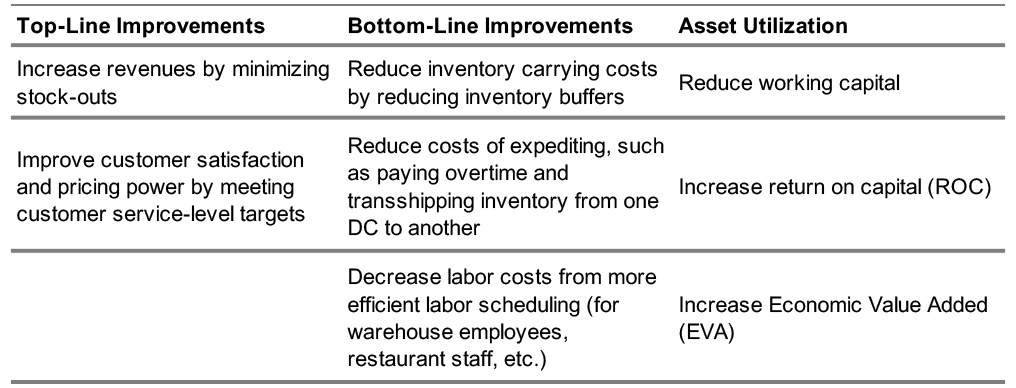

Forecast accuracy benefits top-line, bottom-line, and asset utilization performance, as summarized in the below table. By accurately predicting demand, companies can increase short-term sales by minimizing stock-outs. Over time, as they develop a track record for meeting customer commitments, they improve customer satisfaction, leading to increased market share, improved loyalty, and greater pricing power.

For the bottom-line, accurate forecasting enables companies to keep inventory as low as possible and lower carrying costs. They also minimize expediting costs incurred to rush production and delivery when their forecasts are too low. Accurate forecasts also lower labor costs by allowing companies to match employee schedules with demand.

By generating higher revenues and lower costs, better forecasting increases profitability. This improves the numerator in the calculation of return on capital (ROC). By decreasing inventory, better forecasting decreases working capital and thus decreases the denominator of ROC. The net result is an increase in ROC and ultimately Economic Value Added (EVA).

Quantifying the Value of Demand Forecasting

“Improv[ing] forecasting accuracy by 10 to 20 percent … translates into a potential 5 percent reduction in inventory costs and revenue increases of 2 to 3 percent.”

McKinsey Global Institute

So how do you quantify the financial benefits of a given improvement in forecast accuracy? Such benefits depend on your industry and your company’s unique situation. But some industry averages provide guidance.

In a paper from the McKinsey Global Institute on the potential benefits of artificial intelligence (AI), McKinsey looked at the benefits from using AI for forecasting in the consumer packaged goods (CPG) industry. They estimated that:

- A 10-20% improvement in forecast accuracy could translate into a 5% reduction in inventory costs

- It could also yield a 2-3% increase in revenue

In an article published by the Institute of Business Forecasting and Planning (IBF), Eric Wilson of IBF found that:

- A 15% increase in forecast accuracy will deliver a 3% or higher improvement in pre-tax profitability

- A 1 percentage point improvement in under-forecasting error at a $50 M company generates savings of as much as $1.5 M, and for the same amount of improvement in over-forecasting, $1.3 M in savings

These are guidelines, and actual benefits will of course vary by industry and specific company, but there’s no question that increasing forecast accuracy has real, tangible business benefits.

What’s More Important: Forecast Accuracy or Supply Responsiveness?

A discussion of the value of forecast accuracy often leads to a discussion of the relative value of investing in demand forecasting capabilities versus supply response capabilities. As a vendor of both demand and supply planning applications, we are frequently asked this question. One school of thought is that demand drives the rest of your supply chain, so you should prioritize improving your forecast and then that will take care of everything else. An alternative viewpoint is that no matter how good your forecast is, it will always be wrong, and in some cases very wrong, so you need to invest in improving your supply response capabilities no matter how good your forecasting is.

Deciding whether to focus your supply chain initiatives on demand or supply depends on your current capabilities in each area and the particulars of your business. Any supply chain improvement initiative should begin with a diagnostic of your current capabilities, the needs of your customers, the capabilities of your competitors, and your strategic goals for your supply chain. Going into this in detail would require a separate blog, but here I’ll introduce the concept of forecast value added (FVA), which is key to assessing your current forecasting capabilities.

How Good is Your Forecast: The Concept of Forecast Value Added

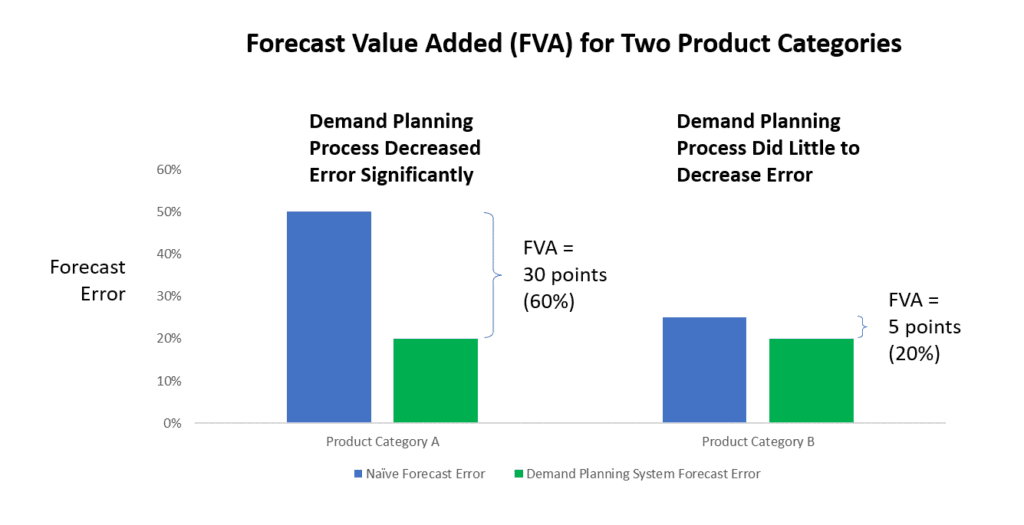

To determine if you should invest in improving your forecasting process, you will want to assess your current forecast accuracy. What’s important is not your absolute forecast accuracy, but to what extent you’ve improved it over the relevant baseline for a particular product. This is known as forecast value added (FVA) and is a measure of the value your forecasting process is providing above and beyond the naïve forecast. The naïve forecast is what you would obtain from the kind of simple forecasting method (such as using a moving average of prior demand) one would use in the absence of a sophisticated forecasting process.

The below chart illustrates one application of FVA analysis. Suppose you sell two product categories, A and B, and you have a similar 20% forecast error for each category. At first, you might think that your forecasting process is equally effective for each category. But after looking at the FVA for each product category, you realize that Category A is inherently more difficult to forecast, since the naïve forecast error is 50%. This could be the result of promotion intensity, competitive activity, etc. So your demand planning process appears to be doing a pretty good job because it is reducing the error from 50% to 20%. By contrast, Category B is fairly easy to forecast, with a naïve forecast error of only 25%. Your forecasting process has reduced this by only 5 percentage points. From this analysis, it’s a pretty good assumption that your forecasting process for Category B is much weaker than for Category A, and you should probably focus your efforts on improving forecasting for Category B. For Category A, you seem to be doing a pretty good job, so perhaps incremental supply chain investment should be spent on the supply response for Category A rather trying to improve demand forecasting even more. (Ideally, you would want to know how low it would be possible to bring down the forecast error, perhaps by benchmarking against competitors, but it’s often difficult to obtain such information.)

Forecast value added is a key concept needed to understand the value forecasting is bringing to your organization and whether you have room to improve. It can play an important role in deciding how to allocate supply chain process improvement budgets across different parts of your business and between investing in demand forecasting and supply response capabilities.

Conclusion

While the benefits of forecasting are not always as obvious as those from lowering inventory or decreasing out of stocks, they are just as important. Forecasting drives the rest of your business and the difference between a good forecast and a bad one can have a huge impact on revenue, customer satisfaction, and profitability. Unfortunately, it’s a lesson that a number of companies are learning the hard way.

To Learn More

If you’d like to discuss how New Horizon can help your manufacturing, wholesale, retail, or foodservice company forecast more effectively, contact us – we’d love to talk.